TORONTO - A proposal to drastically cut insurance payouts for serious car-crash injuries in Ontario had critics crying foul Thursday and warning that accident victims will be forced to pay for some of their own rehabilitation services.

The Financial Services Commission of Ontario has recommended that medical and rehabilitation costs for non-catastrophic injuries be capped at $25,000, down from the current $100,000.

The proposal is part of a package of 39 recommendations contained in a recent five-year review of the auto insurance sector.

Finance Minister Dwight Duncan said Thursday he wants "to strike the right balance" on the insurance changes, and that the government will act on the recommendations by summer.

"I'm hoping by the end of June," he said. "I'd like to get this done."

Premier Dalton McGuinty hinted the Liberal government would be cautious about taking action on auto insurance that would upset consumers, and called the recommendation "nothing more than a proposal" put forward by a government agency.

"Milk's gone up, bread's gone up, rent's gone up ... everything has gone up, but auto insurance premiums in Ontario have come down by 10 per cent," McGuinty said.

"So I would hope that Ontarians would draw some reassurance in our record in that area, and know that we want to be very careful as we move forward."

The Alliance of Community Medical and Rehabilitation Providers said Duncan has a choice to make between higher profits for insurance companies or protection for accident victims.

"If Minister Duncan adopts the proposals, we'll still be paying the same amount or more in insurance premiums, but we'll be getting a lot less if we're injured in a car crash," alliance spokesman Nick Gurevich said in a release.

"A nice deal for the insurance firms (but) highway robbery for the nine million motorists in the province."

A cut of 75 per cent in health care for injured motorists and a zero per cent reduction in car insurance premiums is not a good deal, and would seriously limit the quality of rehab services for accident victims, said the NDP, which wants the $100,000 cap raised, not lowered.

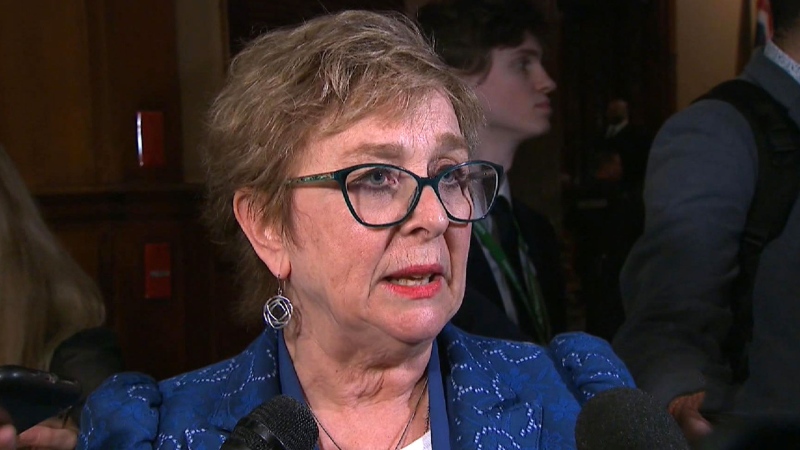

"It's unacceptable that the insurance sector is looking to recap the reduction in its profits -- not even losses on the markets -- on the backs of accident victims," said New Democrat Leader Andrea Horwath.

"That is odious and it's unacceptable and this government should not be falling for it."

The Progressive Conservatives failed to get the government to extend Friday's deadline for public comment on the proposed changes, a delay they said was necessary to make the public aware of what's being discussed.

"I was asking the finance minister not to push through with a very quick decision on this and give Ontarians an opportunity to be aware of what's going on," said interim Opposition Leader Bob Runciman.

"Most Ontarians are completely unaware of these proposed changes."

Runciman said there is "no need to rush this through," and asked the government to take the summer to consult Ontarians on the proposals.

Horwath said the Liberals already made changes to Ontario's Health Insurance Plan that force people to pay for services that were previously covered, and warned that changing auto insurance coverage would only make things worse for accident victims.

"Remember, it's this government that delisted things like physiotherapy, so people can't get those services at a low cost covered under OHIP anymore," she said. "They have to pay."

Someone with what is termed a catastrophic injury would not be affected by the recommended changes and would remain eligible for up to $1 million for rehab costs.