TORONTO - The Toronto stock market is headed for another week of volatility as investors try to assess the damage to the third-largest economy more than a week after an earthquake and tsunami crippled a Japanese nuclear plant.

So far it has been extremely difficult to even start gauging the economic costs of 9.0-magnitude quake and tsunami on Mar. 11.

"People are focused on the near and present danger -- I mean the nuclear issue," said Paul Taylor, chief investment officer at BMO Harris Private Banking.

Investors realize a recovery will be anything but quick as the damage to the country's electricity grid has been immense, which will make it tough for industries to resume production.

"I think more it's the rolling power outages," said Chris Kuflik, wealth adviser with ScotiaMcLeod in Montreal.

"Even if you have a factory that wasn't affected, your factory is still OK and everything is wonderful (but) can you get the power in order to make the goods."

Stock markets have proved remarkably resilient to the Japanese crisis but intraday swings have been violent at times with swings measured in hundreds of points on the main TSX index and the Dow industrials. The TSX ended the week up 0.75 per cent.

That followed a four per cent slide the previous week as a rally that had gone on pretty much non-stop since last summer came to a halt, partly because a jump in oil prices due to Mideast unrest raised questions about the health of the global recovery.

But analysts are quick to point out that a retracement on markets was long overdue.

"We were already correcting and most of the damage to date was done before the earthquake in Japan mainly as a result of oil prices and that's layered another element of risk on top of things," said John Johnston, chief strategist, The Harbour Group at RBC Dominion Securities.

"And so the degree of uncertainty is greater and that certainly suggests the correction could run its course a little more."

Investors still have plenty of other worries to contend with, including the European debt crisis which last week saw a refusal by opposition lawmakers in Portugal to go along with the prime minister's plea to support his minority government's latest austerity measures which seek to avoid a bailout for the debt-heavy country.

And the risk premium on oil isn't expected to contract.

Oil is up roughly 10 per cent in the last month since fighting intensified in Libya. And that premium will remain as long as the geopolitical situation in the Mideast remains unsettled.

The ongoing protests in Bahrain have been particularly unsettling because the kingdom is right next door to Saudi Arabia, the world's biggest crude producer.

It's a slim week on the economic calendar.

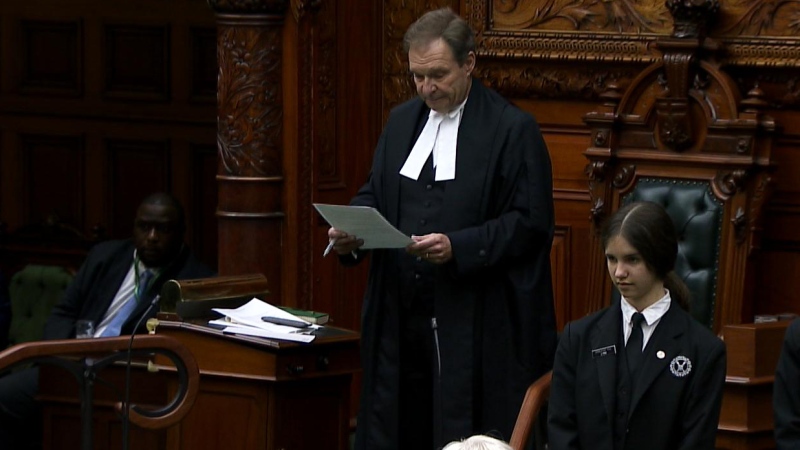

The major Canadian event is the federal budget, to be handed down after the markets close on Tuesday amid increasing speculation that an election will be called.

Also on Tuesday, Statistics Canada releases the retail sales report for January. Economists expect sales rose one per cent, an improvement from a 0.2 per cent dip in December.